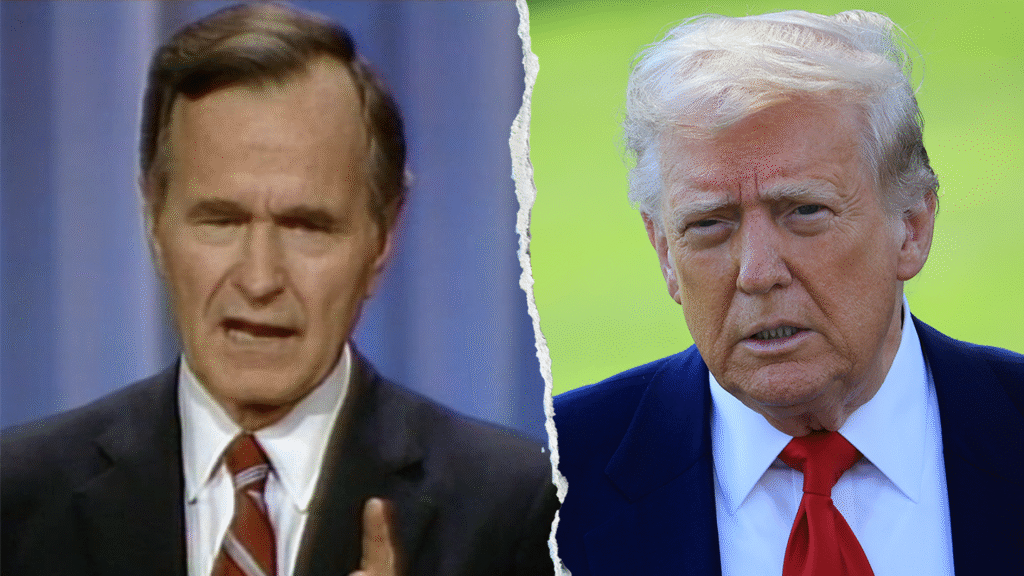

More than three decades after President George H.W. Bush faced backlash for breaking a no-new-taxes pledge, a similar controversy may be brewing. Former President Donald Trump has suggested he might support a small tax increase for high earners—a move some say could risk echoing one of the most infamous political reversals in Republican history.

Back in 1988, then–Vice President Bush made a bold declaration at the Republican National Convention: “Read my lips: no new taxes.” That vow was later broken in 1990 when, as president, Bush agreed to raise taxes as part of a bipartisan budget deal. The political fallout was swift and unforgiving, widely believed to have played a major role in his 1992 loss to Bill Clinton.

Now, experts warn, Trump could be treading the same dangerous ground.

In a Truth Social post on Friday, Trump acknowledged ongoing talks among Republicans in Congress that include the possibility of increasing the top marginal tax rate from 37% to 39.6% for individuals earning $2.5 million or more. Though he didn’t outright endorse the move, he appeared open to it—while simultaneously dismissing concerns that it would be politically damaging.

“I and others would graciously accept a TINY tax increase to help working Americans,” Trump wrote. “But of course, the Radical Left would spin it into another ‘Read my lips’ moment. That didn’t cost Bush the election—Ross Perot did! Still, if Republicans want to do it, I’m fine with that.”

The post sparked immediate concern among conservatives who view tax cuts as a core party value. Former House Speaker Newt Gingrich, who opposed Bush’s tax compromise in the 1990s, warned Trump that such a move could alienate his base.

Speaking on FOX Business with Larry Kudlow, Gingrich said, “This would break the coalition that got Trump elected. It would spark outrage among conservatives and devastate small businesses trying to survive.” He urged the former president to hold firm on his longstanding tax-cut platform.

Trump’s proposed legislative package—frequently referred to as his “big, beautiful bill”—is still being negotiated. It’s expected to feature an extension of the 2017 Trump tax cuts and proposed tax relief for tipped workers, overtime pay, and Social Security benefits. But the suggestion of raising rates for top earners has thrown a wrench into talks.

Political scientist Wayne Lesperance, president of New England College, sees echoes of Bush’s infamous reversal. “Republicans on Capitol Hill must feel like they’re reliving history,” he told Fox News Digital. “The idea of a Republican president even entertaining tax hikes on high earners is politically volatile, especially considering how damaging it was for George H.W. Bush in the early ’90s.”

Lesperance noted that while the circumstances are different—Bush was navigating a Democratic-controlled Congress—Republicans now hold the majority in both chambers. A shift on taxes could hurt the GOP heading into the 2026 midterms if voters see it as a betrayal of the party’s traditional fiscal stance.

David Carney, a longtime Republican strategist and former adviser to Bush, echoed the sentiment. “Bush made a solid deal—he cut spending and raised revenue—but the politics were terrible. It gave both the right and the left a reason to attack him,” Carney said. “It was the single most damaging decision of his presidency.”

Despite the uproar, many fiscal conservatives remain hopeful that Trump won’t ultimately support a tax hike. David McIntosh, president of Club for Growth, expressed confidence in Trump’s commitment to his campaign promises. “He ran on cutting taxes and that’s what we expect him to do,” McIntosh said.

The White House also weighed in, seeking to clarify Trump’s stance. Press secretary Karoline Leavitt reaffirmed the president’s support for low taxes. “President Trump wants to extend the largest tax cuts in American history,” she said during Friday’s press briefing. “He supports eliminating taxes on tips, overtime, and Social Security income.”

Leavitt acknowledged that Trump is open to paying a bit more himself, calling it a gesture of goodwill toward working-class Americans. “It’s a personal belief that shows he’s willing to lead by example,” she said. “But any tax policy changes will be carefully negotiated, and the president will weigh in when the time is right.”

For now, Trump walks a political tightrope—balancing populist messaging with traditional conservative doctrine. Whether this flexibility will serve him well or backfire, as it did for Bush, remains to be seen.

Dedicated and experienced pet-related content writer with a passion for animals and a proven track record of creating engaging and informative content. Skilled in researching, writing, and editing articles that educate and inspire pet owners. Strong knowledge of animal behavior, health, and care, combined with a commitment to delivering high-quality content that resonates with audiences. Seeking to leverage writing skills and passion for pets to contribute to a dynamic and mission-driven team.